Why Choose a Neighborhood Mortgage Broker Glendale CA for Personalized Solution

Why Choose a Neighborhood Mortgage Broker Glendale CA for Personalized Solution

Blog Article

How a Home Loan Broker Can Assist You Browse the Complexities of Home Funding and Funding Application Processes

Navigating the complex landscape of home funding can usually be an overwhelming job for prospective buyers, particularly in a market full of varied car loan options and differing loan provider needs. A home mortgage broker acts as an educated intermediary, geared up to enhance the application procedure and customize their technique to individual monetary conditions. By leveraging their expertise, consumers can not only conserve valuable time but likewise improve their opportunities of safeguarding optimum finance terms. Yet, comprehending the full range of exactly how a broker can aid in this journey elevates vital inquiries about the nuances of the procedure and the potential mistakes to prevent.

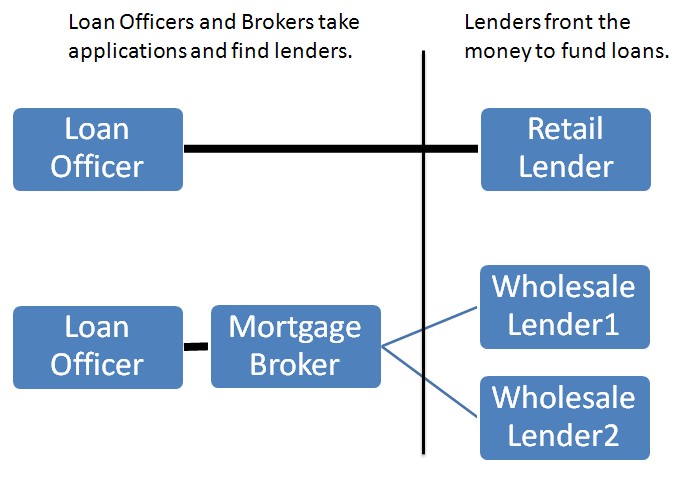

Understanding Mortgage Brokers

Mortgage brokers possess solid relationships with several loan providers, giving clients access to a wider variety of home mortgage items than they may discover on their very own. This network makes it possible for brokers to bargain far better terms and rates, ultimately benefiting the debtor. In addition, brokers aid customers in collecting necessary documents, finishing application forms, and making sure compliance with the loaning needs.

Advantages of Utilizing a Broker

Making use of a mortgage broker uses many benefits that can considerably enhance the home funding experience - Mortgage Broker Glendale CA. Among the main advantages is accessibility to a broader series of financing products from multiple lending institutions. Brokers have extensive networks that enable them to existing choices customized to private economic situations, potentially resulting in a lot more affordable prices and terms

Furthermore, home mortgage brokers give invaluable experience throughout the application procedure. Their expertise of local market conditions and providing methods enables them to direct clients in making educated decisions. This know-how can be specifically beneficial in browsing the documents needs, making certain that all necessary documentation is finished precisely and submitted on schedule.

One more advantage is the potential for time savings. Brokers handle a lot of the research, such as gathering info and communicating with loan providers, which allows customers to concentrate on other aspects of their home-buying trip. Brokers usually have actually established partnerships with loan providers, which can help with smoother settlements and quicker authorizations.

Browsing Car Loan Options

Browsing the myriad of car loan options available can be frustrating for numerous homebuyers. With different kinds of home mortgages, such as fixed-rate, adjustable-rate, FHA, and VA finances, figuring out the best suitable for one's financial scenario requires mindful consideration. Each loan kind has distinct attributes, benefits, and prospective downsides that can considerably impact long-lasting cost and monetary stability.

A home mortgage broker plays an important function in streamlining this process by providing customized guidance based upon individual scenarios. They have accessibility to a broad array of lending institutions and can aid homebuyers contrast various funding items, guaranteeing they understand the terms, rate of interest prices, and repayment structures. This expert understanding can reveal choices that might not be conveniently apparent to the average consumer, such as niche programs for novice customers or those with one-of-a-kind financial situations.

In addition, brokers can aid in identifying the most appropriate financing quantity and term, aligning with the buyer's budget and future objectives. By leveraging their proficiency, property buyers can make educated decisions, prevent typical risks, and ultimately, secure financing that aligns with their needs, making the journey towards homeownership less challenging.

The Application Process

Recognizing the application process is critical for possible homebuyers intending to safeguard a mortgage. The home loan application procedure generally begins with celebration required paperwork, such as evidence of revenue, income tax return, and info on assets and financial obligations. A home loan broker plays an essential duty in this stage, helping clients put together and arrange their economic documents to present a total image to loan providers.

When the documents is prepared, the broker sends the application to multiple lenders on part of the customer. This not just simplifies the procedure yet also allows the borrower to contrast numerous lending choices successfully (Mortgage Broker Glendale CA). The loan provider will certainly after that perform an extensive evaluation of the application, that includes a credit scores check and an evaluation of click the customer's financial stability

This is where a home loan broker can provide invaluable assistance, guaranteeing that all requests are dealt with promptly and properly. By navigating this intricate process, a mortgage broker assists consumers stay clear of potential risks and achieve their home funding goals effectively.

Long-lasting Financial Support

One of the crucial advantages of functioning with a mortgage broker is the provision of lasting economic support tailored to specific conditions. Unlike conventional lending institutions, home loan brokers take an all natural approach to their clients' financial wellness, thinking about not only the immediate car loan requirements however likewise future economic goals. This tactical preparation is crucial for house owners that aim to read this keep monetary security and develop equity with time.

Mortgage brokers evaluate different variables such as earnings security, credit report, and market trends to recommend the most appropriate lending items. They can additionally give advice on refinancing options, potential investment chances, and approaches for debt management. By establishing a long-term relationship, brokers can help clients navigate fluctuations in rates of interest and genuine estate markets, making sure that they make notified choices that align with their developing financial needs.

Conclusion

Finally, engaging a home loan broker can substantially minimize the intricacies connected with home funding and the navigate to this site car loan application procedure. By leveraging their proficiency, debtors access to a broader range of funding items and favorable terms. The broker's function in improving and promoting negotiations documentation improves the general performance of getting a mortgage. Ultimately, the support of a home loan broker not just streamlines the prompt procedure but also offers valuable long-lasting monetary support for debtors.

Home loan brokers possess solid relationships with multiple loan providers, offering clients access to a broader array of home mortgage items than they may discover on their own.In addition, mortgage brokers give indispensable guidance throughout the lending application procedure, assisting clients recognize the nuances of their financing selections. On the whole, a home mortgage broker serves as a knowledgeable ally, enhancing the home loan experience and boosting the likelihood of securing desirable funding terms for their clients.

Unlike conventional lending institutions, mortgage brokers take an all natural approach to their customers' financial health and wellness, considering not only the prompt loan demands yet also future economic goals.In conclusion, involving a mortgage broker can substantially alleviate the complexities linked with home funding and the financing application procedure.

Report this page